SEATTLE — More than a dozen new state laws go into effect in Washington on January 1. The laws deal with everything from privacy in health care to car seat regulations.

Here's a roundup of some of the more prominent ones.

Health

HB 1074 – Raising the smoking age

The smoking and vaping age is raised to 21 years old. Anyone who sells tobacco, e-cigarettes, and vape products to underage buyers will be penalized.

SSB 5889 – Disclosing personal health information

Patients who are listed as a dependent on a health care plan have more protections. Health carriers can’t require dependents get a policyholder’s permission before that person receives services. Also if a dependent receives services for sensitive health issues like reproductive health, domestic violence, or mental health, the carrier must communicate only with the person who received services.

SB 5298 – Marijuana product labeling

Labels of Department of Health compliant marijuana products may include claims that describe the product's intended health benefit. Products with these types of labels must include the following disclaimer: "This statement has not been evaluated by the State of Washington. This product is not intended to diagnose, treat, cure, or prevent any disease."

Labels may not, however, claim to diagnose, mitigate, treat, cure, or prevent disease. They cannot be false, misleading, or appealing to children.

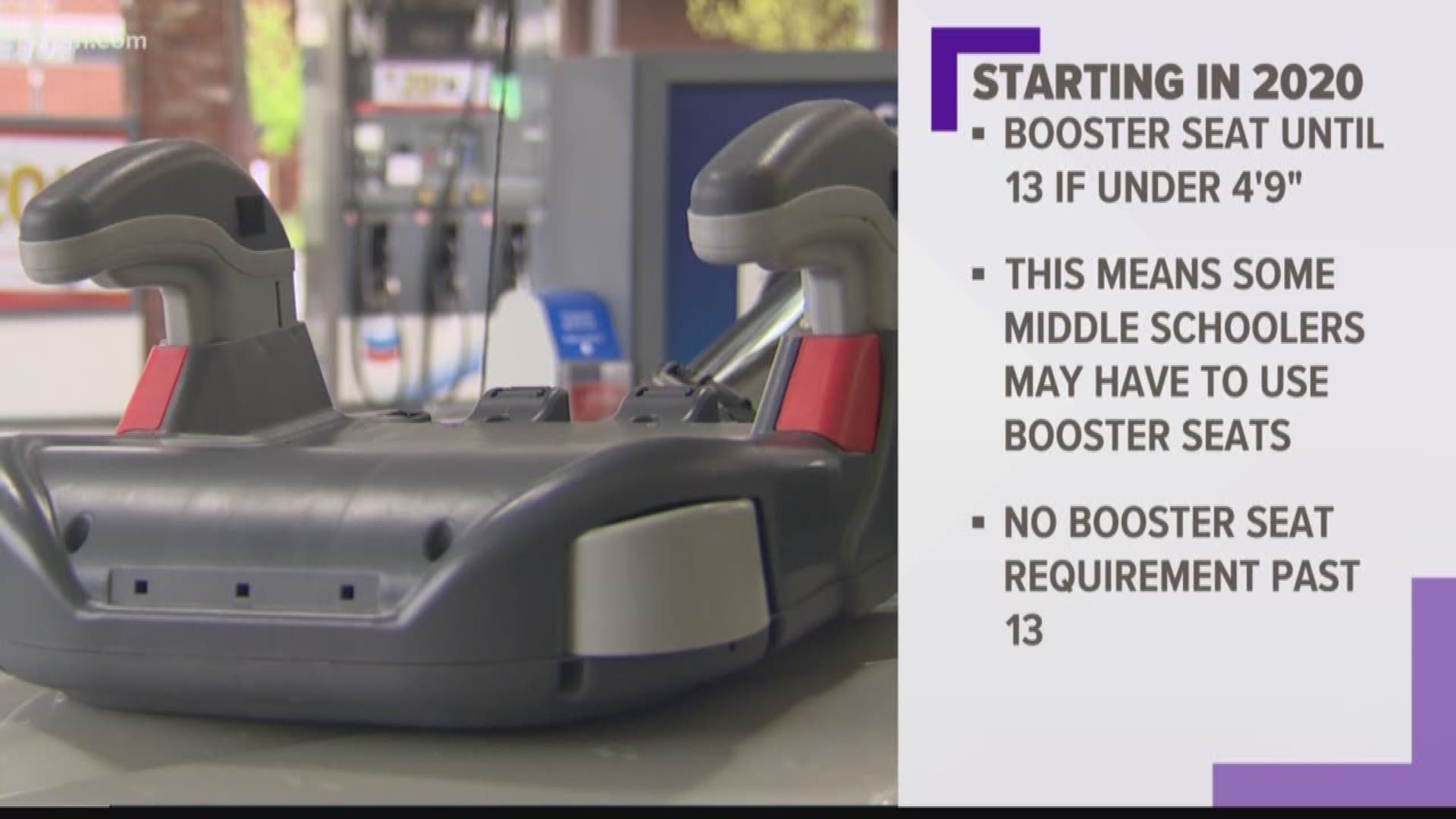

SHB 1012 – Car seat restrictions

Children under 2 years old must be secured in rear-facing car seats. Kids under 4 years old must be secured in a front-facing car seat with a harness. Youth who are less than 4 feet 9 inches tall and younger than 16 must be secured in a booster seat. The one exception to the booster seat rule is if the car only has lap belts.

Traffic

HB 1116 – Motorcycle permits and endorsements

To get a motorcycle permit, drivers must pass a basic knowledge and skills test. Previously, drivers did not need to pass a skills test to obtain a motorcycle permit. To get a motorcycle endorsement, drivers must pass an advanced knowledge and skills test. Previously, motorcyclists could either take an exam or complete a training and education program to become endorsed.

The length of time a motorcycle permit is valid increases from 90 days to 180 days.

An additional $250 fine for driving without a driver's license with a valid endorsement is also enacted. Drivers can now be fined a total of $386 with fees and assessments, up from $136.

SB 5723 – Road safety

Increases the penalty for some infractions for drivers and dedicates those fines to fund education for officers, prosecutors, and judges regarding opportunities for traffic violation enforcement. Drivers who improperly overtake and pass, follow to closely, or fail to yield to pedestrians, cyclists, or other "vulnerable" user of public right of way will be fined an additional penalty.

Pets

HB 1026 – Breed-based dog regulations

Breed bans aren't entirely blocked under the new law, but cities and counties do need to go through a specific process before enforcing restrictions on dog ownership based on breed. Owners who prove their pooch is well-behaved through a program like the American Kennel Club’s Canine Good Citizen Program can get an exemption for their dog for at least two years. Dogs that fail the program can also retest during a reasonable amount of time.

Worker's rights

ESSB 5035 – Contractor wage laws

Employees who work for contractors now have 60 days instead of 30 to file a complaint about nonpayment of wages. Penalties for not paying those employees is now at least $5,000 or 50% of the wage violation, whichever is bigger, with 1% interest monthly. There could be higher penalties if a contractor is a repeat offender.

HB 1155 – Breaks and overtime for healthcare workers

Requires employers to provide uninterrupted meal and rest breaks for nurses, surgical technologists, diagnostic radiologic technologists, cardiovascular invasive specialists, respiratory care practitioners, and certified nursing assistants. Additionally, mandatory overtime prohibitions are expanded to the same groups of employees – though those provisions do not apply to some employees until July 1, 2020.

HB 1450 – Non-compete work agreements

Non-compete agreements are void unless meeting a certain threshold. Non-compete agreements are only enforceable if worker earns more than $100,000 a year, a contractor earns $250,000 a year and the employer discloses the terms of a non-compete when making an offer.

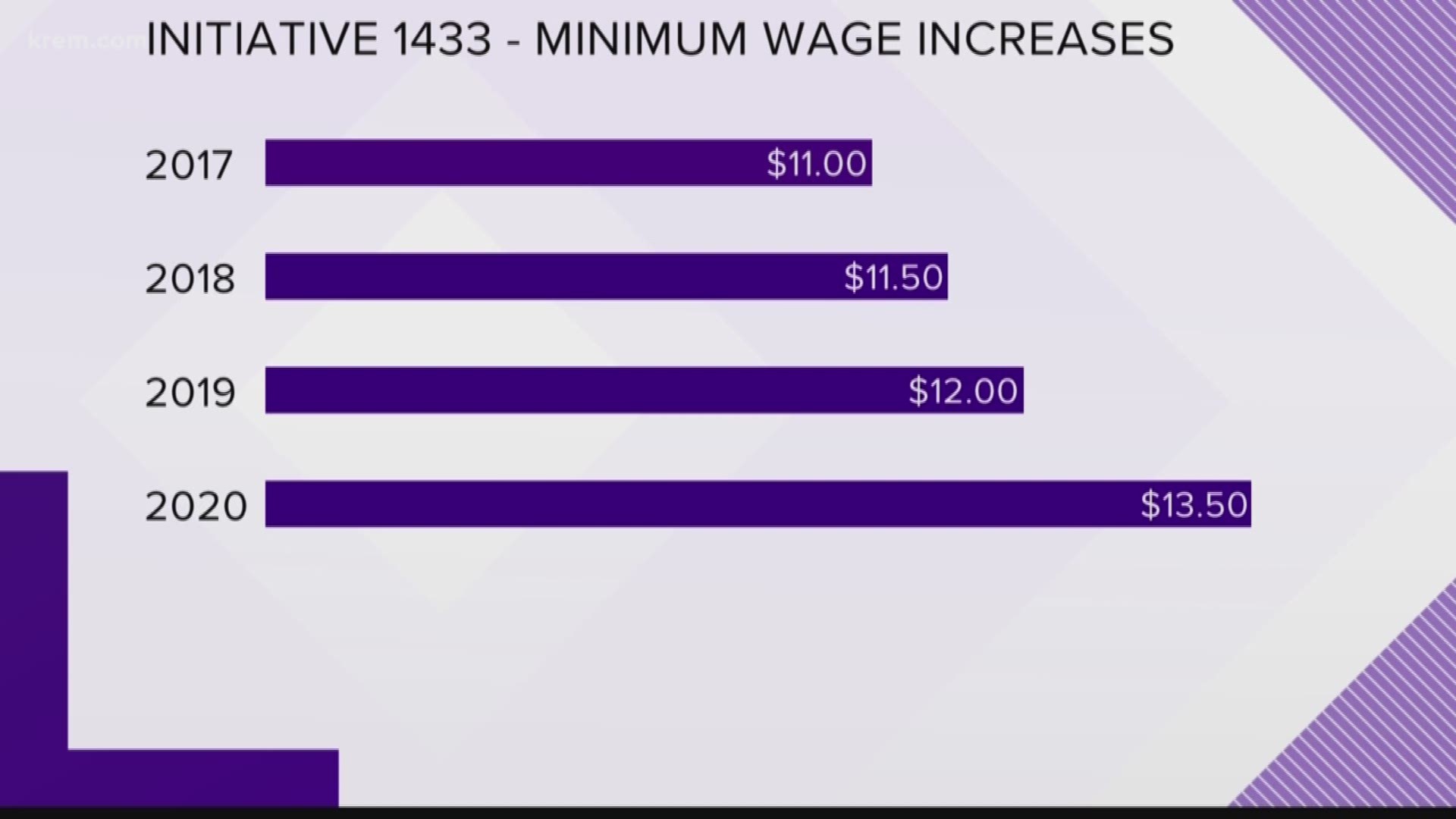

Minimum wage

Seattle and Washington state will both bump their minimum wages in January. The state minimum wage will increase from $12 per hour to $13.50 per hour. Seattle’s minimum wage will increase to $16.39 per hour for companies with more than 500 employees and $15.75 per hour for smaller companies where employees don’t earn $2.25 per hour in tips or medical benefits. If employees do earn those benefits, they will earn $13.50 per hour.

Paid family and medical leave

Employees who work 16 hours per week can take up to 12 weeks of paid family and medical leave annually. You can take 16 weeks if you give birth, and you may qualify for 18 weeks if you have pregnancy complications.

The program is funded through employee and employer contributions. A worker earning $50,000 a year will get about $2.44 deducted from their paycheck each week.

Taxes

HB 1105 – Home foreclosure protection

Treasurers must provide notice to each taxpayer whose taxes are delinquent. Tax notices must specify where taxpayers can obtain information regarding: current taxes or special assessments due; any delinquent taxes or assessments; contact information for statewide hotline.

HB 1301 – Leasehold excise tax exemption

All leasehold interest in the public or entertainment areas of a qualifying arena may be exempt from the state's leasehold excise tax. An arena must have seating capacity of more than 2,000, be located on city-owned land, and be owned by a city of more than 200,000 people within a county with a population of less than 1.5 million.

SB 5998 – Real estate excise tax

Beginning January 1, the real estate excise tax is imposed at the following rates:

- 1.1% if the selling price is equal to or less than $500,000

- 1.28% on the portion of the selling price that is greater than $500,000, but equal to or less than $1,500,000

- 2.75% on the portion of the selling price that is greater than $1,500,000, but equal to or less than $3,000,000

- 3% on the portion of the selling price that is greater than $3,000,000

A rate of 1.28% is imposed on the sale of undeveloped land, timberland, agricultural land, and water or mineral rights, regardless of selling price.