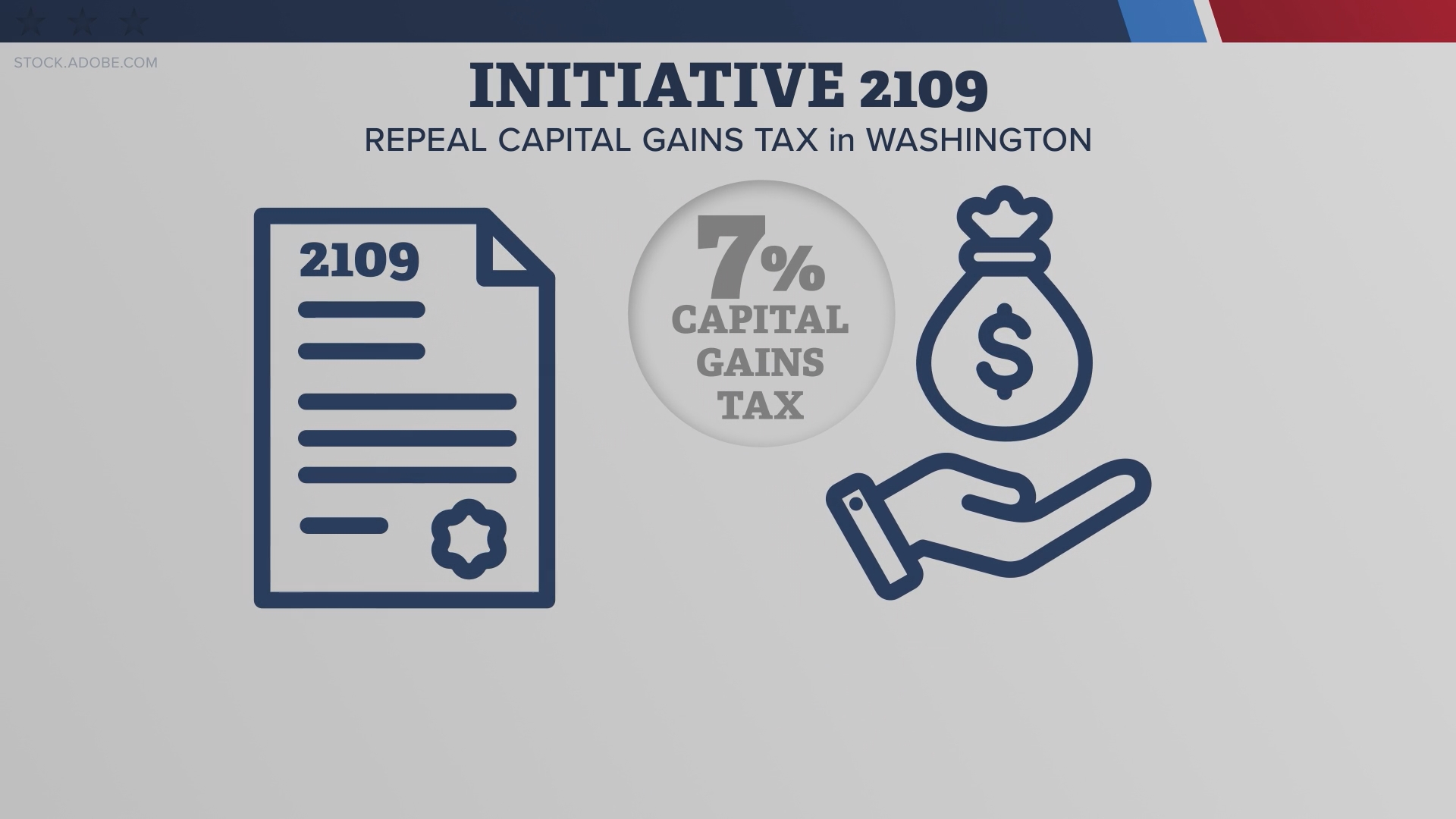

OLYMPIA, Wash. — Washington voters will see multiple Initiatives on their ballots in November, one of them being Initiative 2109.

If passed, I-2109 would repeal the 7% capital gains tax imposed on sales and exchanges of long-term capital assets by individuals with capital gains over $250,000.

Since 2022, sales including stocks, bonds, business interests, or other investments have been subjected to the capital gains tax.

Money from the tax goes to measures like childcare subsidies for qualifying families, bonuses for childcare centers offering hard-to-cover hours, and school construction. The tax went to the state Supreme Court in 2023 and was ruled constitutional.

Roughly 4,000 Washingtonians paid the tax in 2023.

Who opposes I-2109?

Opponents of the initiative say it would take billions of dollars away from child care and education over the next few years.

Invest in WA Now, which opposes the initiative, said it would, "Take more than $5 billion from child care and education over the next 6 years."

The statement goes on to say in part, "The capital gains tax is just on Wall Street stock profits larger than $250,000. Only 4,000 people paid the tax last year, but that sent nearly $900 million to expand childcare, provide more early learning, and repair our schools."

Who favors repealing I-2109?

Supporters of repealing the initiative say the capital gains tax serves as a kind of income tax, which conflicts with a long tradition of prohibiting a state income tax.

Initiative sponsor and Republican State Representative Jim Walsh says, "Washington has a long tradition, both legal and cultural, of prohibiting a state income tax. This tradition reflects the common-sense principle that a state tax on capital gains is a type of state income tax. Every other state that has a capital gains tax considers it an income tax."

Representative Walsh goes on to say, "Our state’s economic and technological growth hub status has been attributed to the absence of a capital gains income tax, fostering job creation and generating tens of billions of dollars in wealth."

For the full Initiative text and more details on who opposes and supports the initiative, visit this link.