IDAHO, USA — About a month ago, The 208 did a story on how the formula for how Idaho lottery money helps Idaho schools would be changing for just the third time in 35 years. It would be going back to being split between funding school district facilities, and the state's permanent buildings.

That prompted Jim in Canyon County to write in:

"Appreciated the piece on the lottery funds.How about history of sales tax that started at 3% with a sunset which obviously didn't happen. It was sold as going to schools as I recall. Jim in Canyon County]

Appreciated the piece on the lottery funds.

How about history of sales tax that started at 3% with a sunset which obviously didn't happen. It was sold as going to schools as I recall."

Well, Jim, you are close. The 3% and going to schools, check. The sunset, not so much.

With the new fiscal year now about a week old, we at The 208 thought it would be a good time to revisit Idaho revenues.

Let's take you back to 1965.

When the legislative session convened, Governor Robert Smylie wanted several things.

He wanted to create a constitutional revision committee, a state water resource agency, a state parks system and a statewide junior college system. Governor Smylie got all those things, and one more.

Something that was tried three times before.

The 38th Idaho Legislature was considered the most progressive in the state's history 59 years ago. None captured that more than what was considered the top story of 1965.

In the news business each news gathering force makes its own evaluation of the top stories of the year.

Channel 7 news team viewed the year 1965 this way.

"1965 was a year of changes and a good many of them came from beneath the Idaho state house dome," states a newscast.

Those changes began with Governor Smylie's State of the State Address in January of 1965. When the Republican incumbent proposed a statewide sales tax.

"The budget when it reaches you ... will be based upon and will recommend ... the enactment of a retail sales and use tax designed to produce revenue adequate to the needs of these expanded services," Smylie said.

His detractors called it political suicide.

House Bill 222 reduced income and property taxes by $26 million. To make up for it, it would also install a first-ever sales tax of 3%, with dividends dedicated to Idaho Public Schools.

"The only practical and the only feasible means of meeting the needs of our schools and our state government, if you regard yourselves as liberals, you should be supporting this legislation because we cannot do those things for the people that we ought to be doing for the people without this kind of legislation," Smylie said.

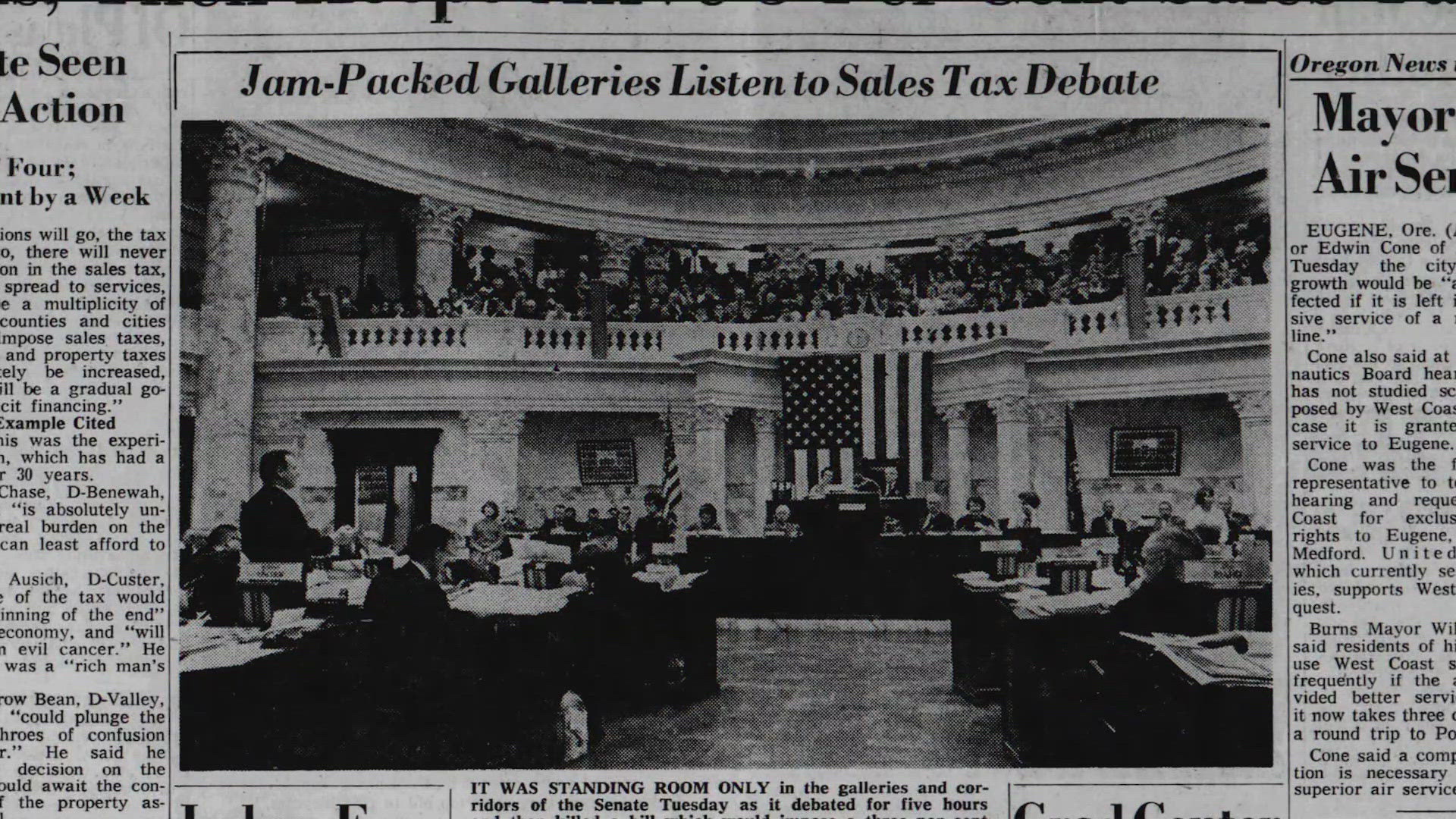

It was not an easy sell, but in the end the senate bought in, 26 to 18. The governor had his sales tax for the time being.

The next November, 61% of Idaho voters upheld the sales tax, but they did ditch the governor and replaced him with a new Republican leader. Idaho has had a sales tax ever since.

Jim also mentioned that sales tax sunsetting. That was never part of the plan, but that term did come into play decades later.

Starting with 3% in 1965, and voter approved in 1966, Idaho stuck with that number until March of 1983. Then, an era of volatility pushed it to 4%, then 4 and-a-half%, then back to 4% 30 days later.

By April of 1986 the sales tax was at 5%, and it stayed that way until 2003, when it rose to 6%.

That's where Jim's "sunset" comes into play. House bill 400 in 2003 set a end date of June 30 2005, in hopes of increasing general fund revenues by $13 million.

Then in August of 2006, Jim Risch was half-way through a 7-month term, having been appointed governor by Dirk Kempthorne to finish out his term when he left to run for the Department of the Interior. In a one day special session, Risch convinced the legislature to cut property taxes for public schools by $260 million, pushing them to rely on income taxes and a new sales tax rate of 6%.

That november, 72% of voters agreed to the sales tax increase.

There was no real tax relief, and two years later schools got kicked in the teeth because of the great recession. Finally, just four-and-a-half years ago, Senator Jim Rice of Caldwell, pitched an idea of pushing the sales tax to nearly 8%, with the extra money going to Idaho schools, and a goal of getting rid of the need for supplemental levies.

That went nowhere.

So, we have had several raises to the state sales tax since 1965, but none since voters overwhelmingly approved taking it to 6%, and we've been that way ever since.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.