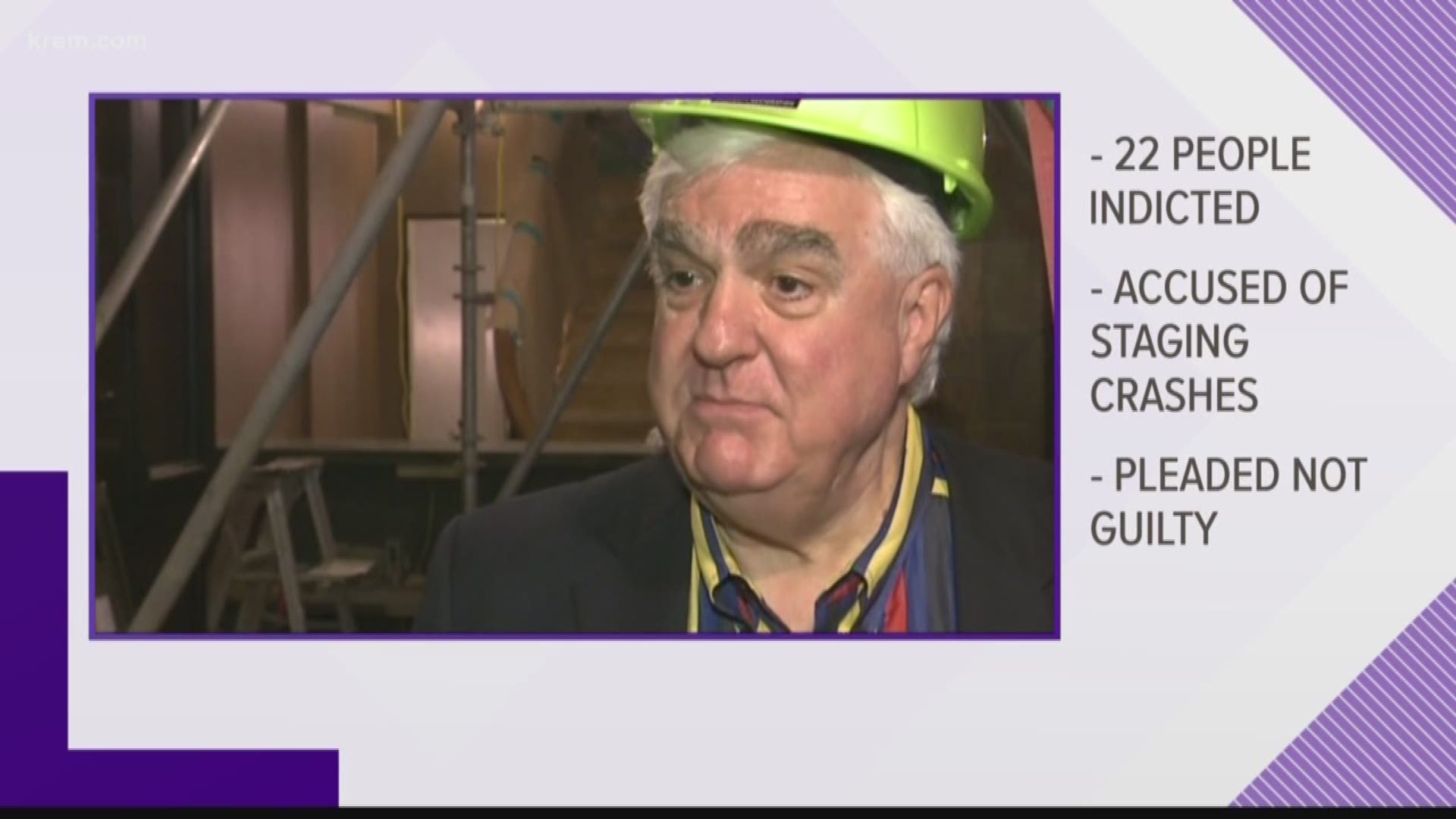

SPOKANE, Wash. — Ron Wells, a prominent Spokane architect and developer, has entered a not guilty plea to charges of fraud stemming from a "scheme to defraud insurance companies."

Wells entered the plea in the United States District Court for the Eastern District of Washington in Spokane on Monday, according to court documents.

He is not being held in jail during the case, according to the documents.

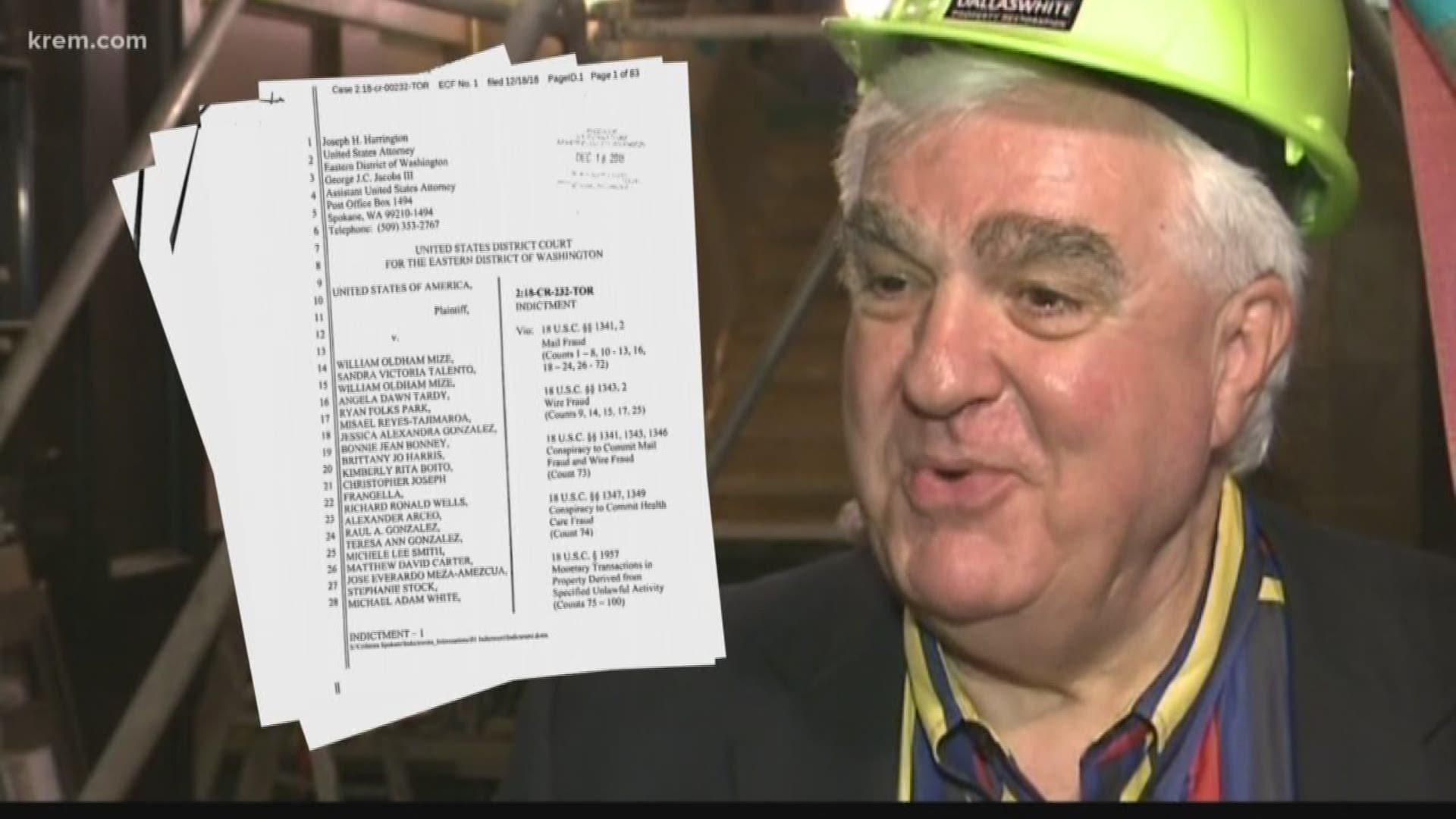

Wells was named as one of 22 defendants who were indicted in federal court for an alleged scheme to defraud insurance companies that was first reported on in December.

According to the indictment, the scheme, led by Spokane County resident William Mize, began around Sept. 11, 2013. All 22 defendants are accused of engaging in a “scheme to defraud insurance companies and to obtain money from these companies by means of materially false and fraudulent pretenses, representations, and promises.”

Wells is charged with mail fraud, wire fraud, conspiracy to commit mail fraud and wire fraud and monetary transactions in property derived from specified unlawful activity.

Wells' attorney, Kevin Curtis, issued a statement in December evening saying his client was recently in a medically induced coma and plans to fully cooperate with the investigation.

"As has been reported, Mr. Wells has been indicted along with 19 other defendants in United States District Court, Eastern District of Washington. Mr. Wells intends to continue fully cooperating with the government. This process was cut short approximately 9 weeks ago when Mr. Wells was put into a medically induced coma for three weeks after suffering a setback while recuperating from surgery. After awakening from the coma , Mr. Wells was then transferred to rehabilitation facilities where he remains with the hope he will be able to return to his original level of functioning."

The statement goes on to say that Wells plans to assist the government by taking steps to detail his involvement with the primary targets of the investigation.

"It is Mr. Wells' sincere hope that the projects in which he is involved will not be jeopardized by his personal situation nor to detract from his numerous civic contributions over the years," Curtis said in the statement.

News of the indictment charges against developer Ron Wells and several other Spokane County residents shocked the community.

One man contacted KREM, saying he's been an employee of Wells for more than 18 years. He adds, Wells has done more for Spokane's downtown that anybody.

Wells has led several development projects in Spokane since 1983. His latest project has been turning the historic Ridpath hotel into apartments.

Wells became inspired by historic buildings, and made it his mission to preserve as many as he could. Doing so helped revive Spokane's downtown at the same time. Many of his projects qualified for historic tax credits.

You can find most of the buildings he saved spread out along Riverside Ave, 1st and 2nd Avenue and a few in Browne's addition. The Eldridge building on 1st Avenue now houses Rocket Bakery and Fringe and Fray.

Down Riverside Avenue, the San Marco Building and this one overlooking Peaceful Valley are just a few of the buildings Wells transformed into apartments.

Back in 1996, Wells discussed plans with Avista to renovate the Steam Plant. Reports said the Steam Plant became Spokane's first building to receive the National Preservation Honor Award. It recently underwent some additional renovations, and remains an iconic feature in Spokane.

Mize and the co-conspirators were involved in 33 staged accidents total, and approximately six accidents per year, the indictment alleges. The accidents included car, boat, stair falls, pedestrian/vehicle and other accidents in eastern Washington, Idaho, Nevada and eastern California.

“A high percentage of the planned automobile crashes were two-vehicle accidents on remote roads at night where there were no witnesses other than the co-conspirator occupants of the intentional crashed vehicles,” the indictment said.

According to the indictment, the co-conspirators would let Mize use their cars for the purpose of staging a crash and obtaining an insurance payout. Mize would deliberately drive the pre-planned “at fault” car into the pre-planned “no fault” car at a pre-planned location, the indictment states.

“Prior to a staged accident, Mize purposely inflicted injuries on a co-conspirator to mislead responders and insurance companies into believing the co-conspirator was injured in the in the accident and to increase insurance payouts,” the indictment said. “Mize required co-conspirators to urinate in a bottle and pour urine on their clothing to create the false and misleading impression that a co-conspirator suffered a loss of consciousness.”

According to the indictment, the defendants made “false material representations to police, emergency and medical personnel and insurance company representatives about the manner in which the accident occurred and the cause, nature and extent of their injuries.”

The defendants would also use fake names, identities, social security numbers, dates of birth, employment records and email addresses to make false insurance claims, documents said.

They’re also accused of falsely representing their injuries, according to the indictment.

“The Defendants staged some accidents as a fraudulent way to induce insurance companies to pay for medical treatment for a pre-existing injury, totally unrelated to and not caused by the accident,” documents said.

Settlements for some of the defendants were hundreds of thousands of dollars, documents said.

The indictment said Mize along with Ron Wells, Sandra Talento and Christopher Frangella, staged a crash on Appleway in Liberty Lake on Oct. 16, 2016. The crash involved Wells’ 2015 Ram 3500 truck and Frangella’s 2005 Ford 250, documents said. Everyone involved filed fraudulent insurance claims, documents said. They received settlement payouts totaling $338,266.75 from Safeco insurance.

According to the indictment, on April 21, 2016 Mize and Wells were involved in a teller transfer of $225,000. Then on March 21, 2017, Mize and Wells were involved in a $100,319.56 cashier’s check purchase that was used to pay off a mortgage on property in Spokane.

Wells does not plan on issuing any additional statements until agreements have been reached with the government, his attorney said.