SPOKANE, Wash. – Spokane County is going to see the largest property tax increase in its history.

The state Supreme Court ruled Washington was under-funding education. Increasing the property tax means all that money can go to education.

The increase in your state property taxes will not last forever. It will last four years, then rates will go back to the usual "budget-based system." The new tax rates vary by county to make sure properties of equal market value across the state pay the same amount to fund basic education.

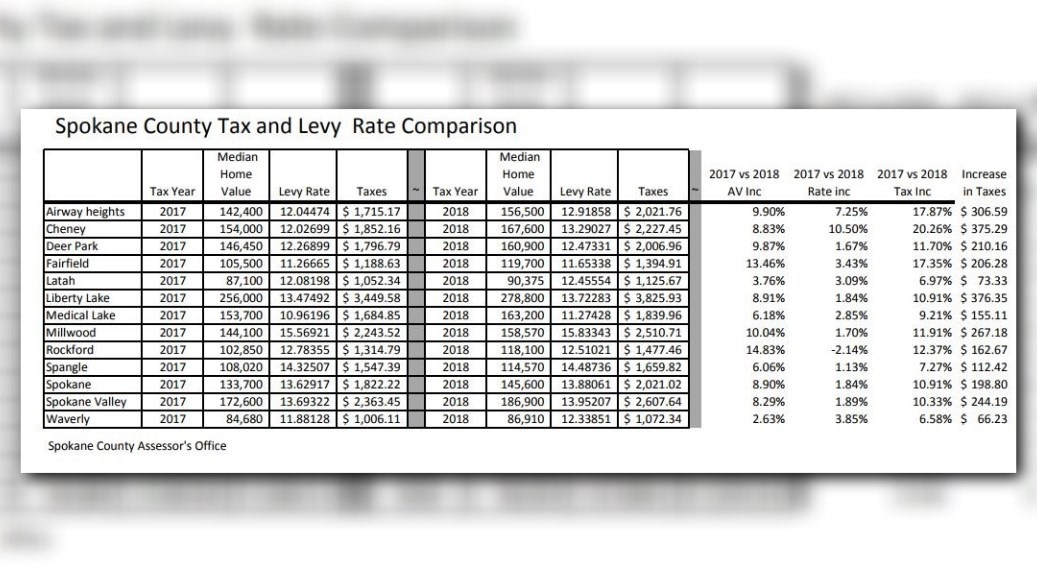

For Spokane County, the state raised the property tax rate by 98.6 cents per $1,000 of assessed value. The Spokane County Assessor’s Office shared a breakdown of what taxes will increase in each city.

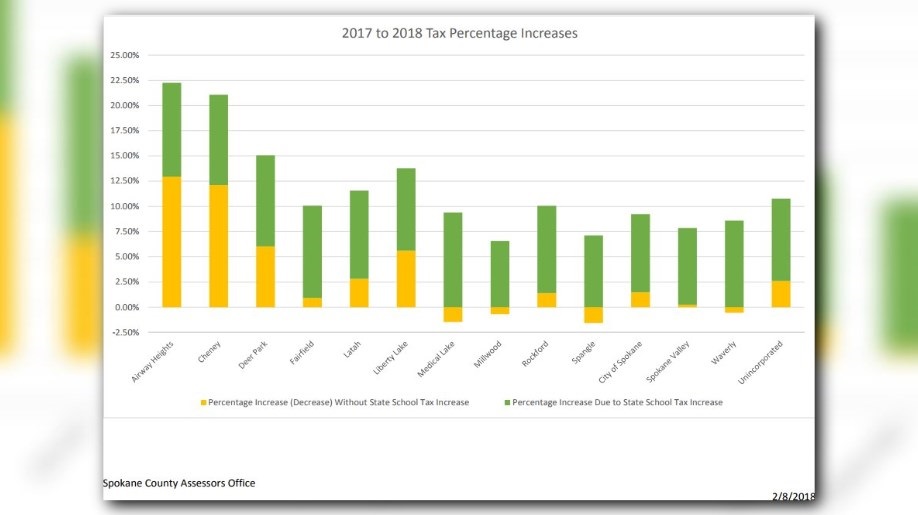

On the graph above, the yellow represents local levies and measures. If you look at Millwood, this year it won't see any property tax increases from local levies. Whereas, in Airway Heights, its local levies will increase property taxes by more than 12 and a half percent.

When you add the new state school tax, Airway Heights property taxes this year will increase by a total of about 22 percent. Millwood will now see about a six percent increase.

You could still see your property taxes increase or decrease over the next four years because while the state's tax rate is fixed for the next four years, your local measures could still fluctuate. For example, maintenance and operations levies for almost all school districts in Spokane County will drop to $1.50 from as high as $4.

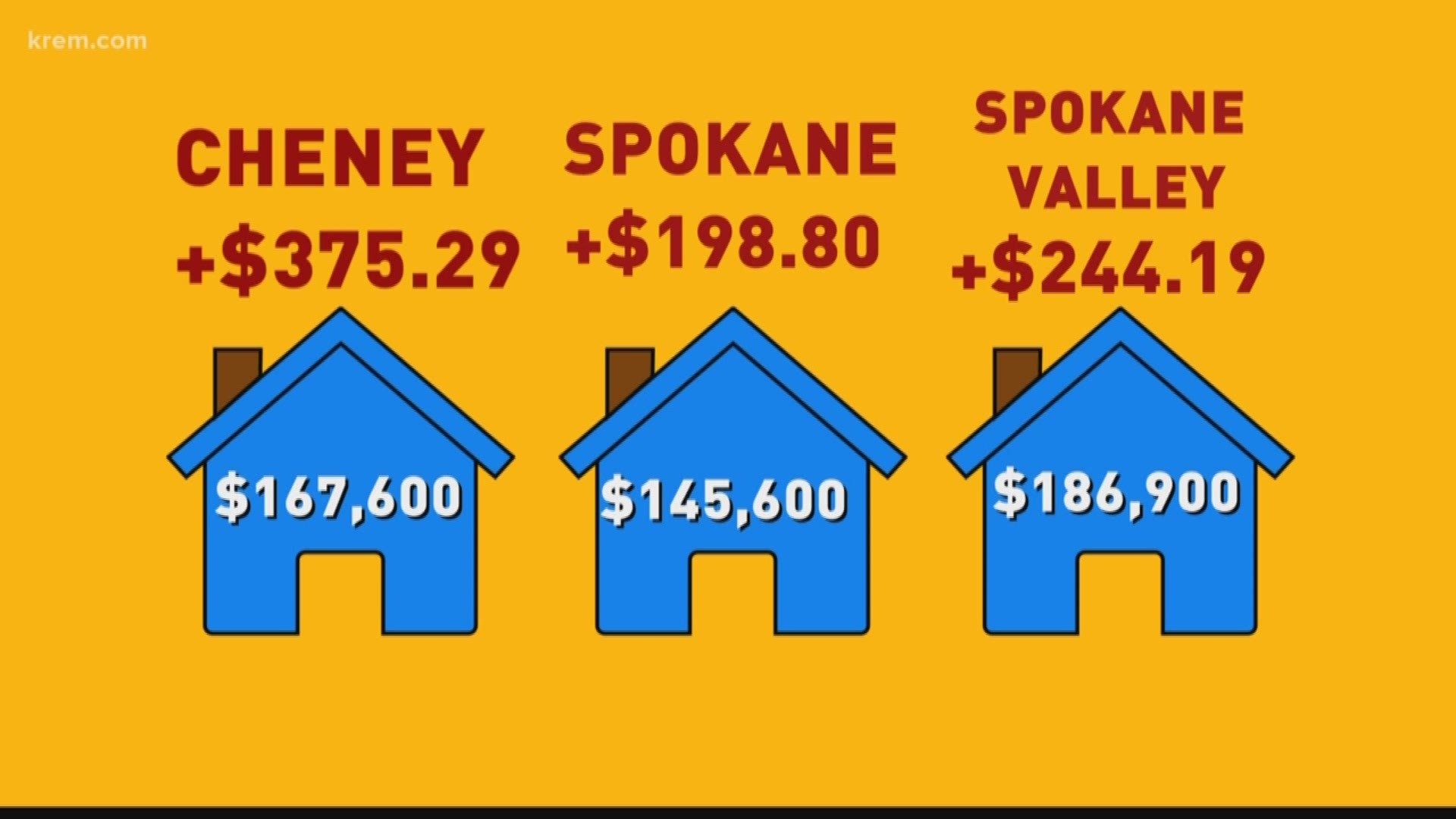

Cheney will see the highest property tax increase. The Spokane County Assessor's Office says for a Cheney median valued home of $167,600, there will be $375.29 annual increase in property taxes. This total includes the state school tax and taxes from local measures.

For a median valued home of $145,600 in Spokane, there will be a $198.80 property tax increase. For a Spokane Valley home with a value of 186,900, property taxes will increase by $244.19.

The Assessor's Office said it is important to note that the upcoming Spokane County election results will not apply to this year's tax year whatever measures get approved will apply to 2019.