BOISE, Idaho — The idea of a "home" is changing. When I was growing up in Meridian, a "home" meant a house of at least 2,000 square feet on an eighth of an acre, with at least three bedrooms and two baths. That mindset is changing in this area, though. A "home" can now mean a duplex, triplex, or an apartment. That's been the case in bigger cities for ages, but as the Treasure and Magic Valleys grow and change, we are seeing our towns turn into bigger cities.

Why is this mindset changing? We talked to Rick Murdock recently, who is the CEO and Co-Founder of Autovol, a Nampa automation company that builds modular apartments. He said, we have less room in the area for big houses, people want less house and yard to care for, but the main reason is of course, the cost of homes.

"I think it's driven by cost one, right? Today, if you want to go out and buy that home that you were talking about, there's a large percentage of the population that can't afford that anyway. They can't even afford the down payment for that. And then the interest rates on top of it. And as interest rates go up this time, so do housing costs. And that's kind of out of the norm as well,” said Murdock. “I think other people are looking at, okay, I can't afford a home, so what's my best option? And they're looking for a place that they can fit and have an address. I think that's part of the driver. But you also have young people that like to be nimble. They don't have the same desires that we had when we were young, and they want to be loose and be able to move around and travel and do those things. So, you have a lot of different things going on with the housing markets. But I think for me, I believe that the main thing that's driving it is cost."

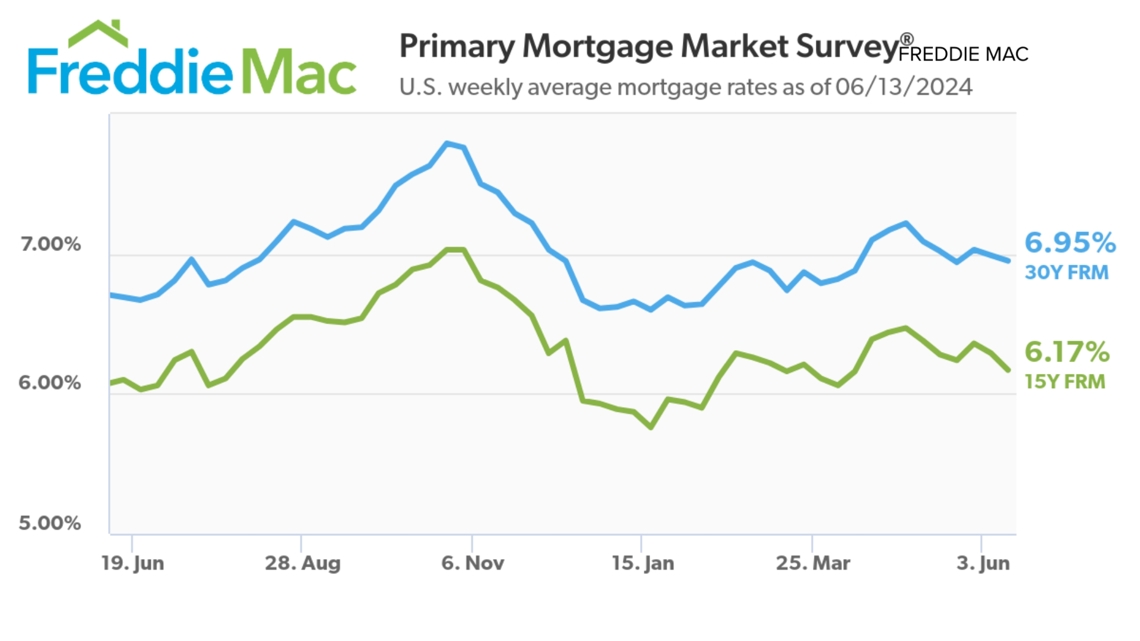

A big part of that cost is interest rates. Just a few days ago, the Federal Reserve did not change its key interest rate. The Chairman said they're looking at maybe cutting it just once before the end of the year. That means mortgage rates are going to stay about where they are for a while. According to Freddie Mac, the average 30-year mortgage rate is 6.95%. That's ticking down, which is good news, even though they won't drop much more.

That's helping the market heat up. According to the Intermountain MLS, year over year, the number of home sales is up in both Ada and Canyon Counties. And while the median sale price is up too, it's only up a little. Meanwhile, the inventory is way up! Ada County has 40% more homes available this time of year than last. Canyon County has 68% more homes available this time of year than last. Those are massive and much-needed spikes in inventory.

I heard from a local REALTOR®, Jennifer Stiffler, who says that increased inventory is slowing competition, which you'd think would drop prices. But as we've seen, those prices are still on the rise. Stiffler says, that's because even though those inventories have spiked, they're still less than 3 months’ supply. And an ideal supply is between 4 and 6 months.

That will keep demand relatively high, which again, is why the mindset for what a "home" is continues to change, because smaller homes are just what most people can afford.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist:

HERE ARE MORE WAYS TO GET NEWS FROM KTVB:

Download the KTVB News Mobile App

Apple iOS: Click here to download

Google Play: Click here to download

Watch news reports for FREE on YouTube: KTVB YouTube channel

Stream Live for FREE on ROKU: Add the channel from the ROKU store or by searching 'KTVB'.

Stream Live for FREE on FIRE TV: Search ‘KTVB’ and click ‘Get’ to download.