SPOKANE, Wash. — People across Washington and Idaho are suddenly faced with figuring out how make ends meet after stay-home orders due to the coronavirus pandemic have ground the economy to a halt.

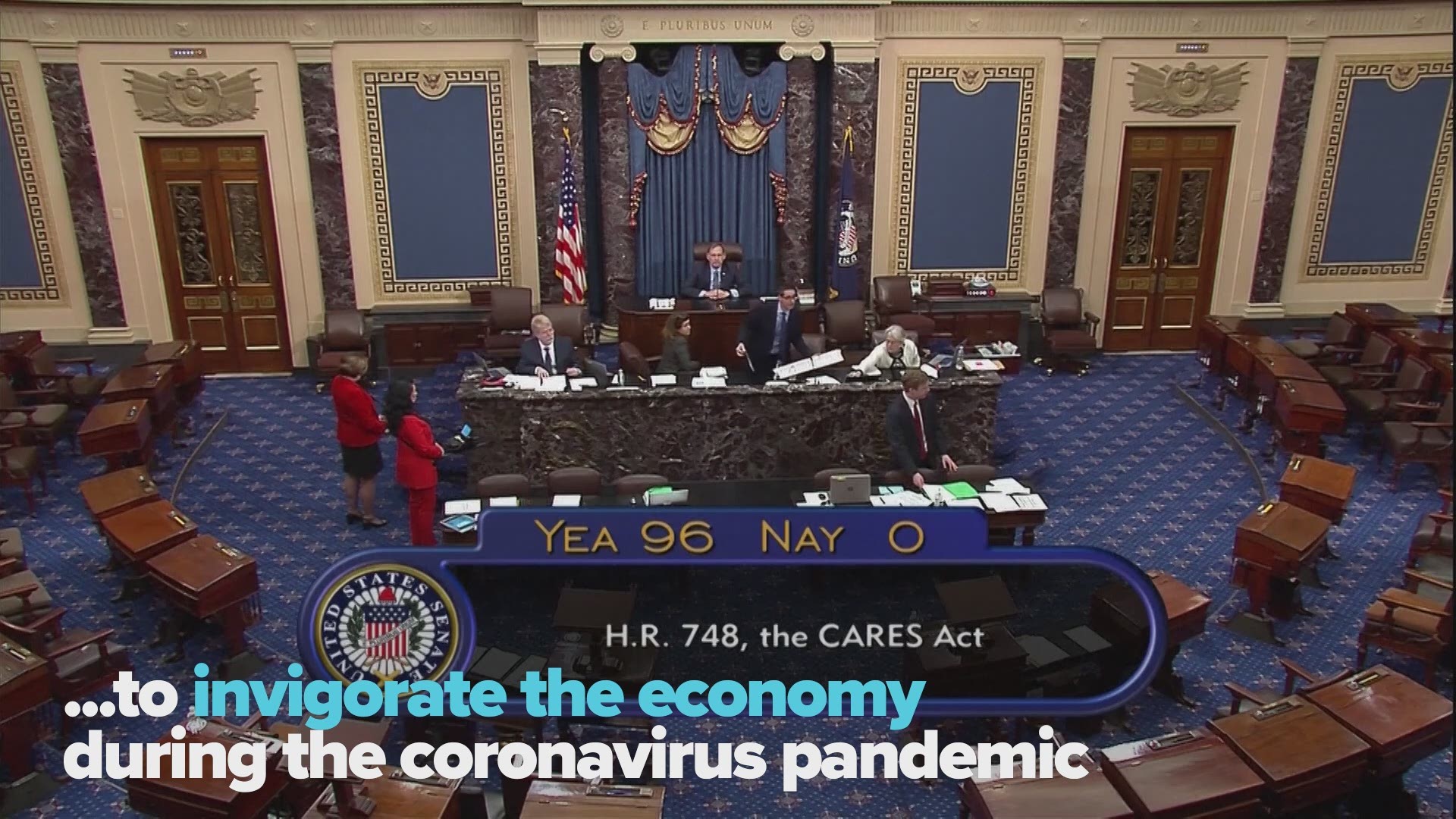

Whether you’re facing unemployment, furloughs, lost wages or cut hours, there are new provisions that allow many people to file for unemployment, loans, or get relief on bills. In addition, most Americans have received or will receive stimulus checks.

Here’s what you need to know about how much government money you can access and how to make sure you get it as fast as possible.

Do you have a question you don’t see listed here? Write to us at newstips@krem.com and we will do our best to add answers to this article.

How can I make sure I get the stimulus check from the CARES Act?

Most Americans will get a sizable check from the federal government as part of the coronavirus stimulus emergency relief bill, if they haven't already.

People who make less than $75,000 will get a $1,200 payment ($2,400 for a married couple making less than $150,000), and an extra $500 per kid under the age of 16. People who make more than $99,000 a year or $198,000 for a couple will not get a check, and the folks in between will get a lesser amount.

To make sure you get your check, you need to have filed your taxes for last year or this year. If you’re on social security disability or otherwise don’t file a tax return, you can still get your payment. The government will use the information on the Form SSA-1099 and Form RRB-1099 to generate the payments.

The government has created a portal where you can input your bank account information, if you don't otherwise filed taxes.

When will I get my stimulus check?

It depends if the IRS has your direct deposit information or not. If you filed taxes and got a direct deposit, or if you fill out the direct deposit information on the IRS website, you should get money deposited directly to your account. Many people got their checks starting in mid-April.

But there have been some hiccups - a lot of people who have direct deposit info on file are still waiting. Here's why.

If you don’t have direct deposit information on file, you’ll have to wait a little longer. The feds will be sending checks to people in the lowest income brackets first, and then to each higher income bracket, from the end of April through September. So if you make $75,000-$99,000 a year, expect your check to arrive in the mail sometime in late summer.

And if for some reason, you never get paid this year even though you should have, you can still get the money in next year’s tax return. The stimulus payment is a tax credit on your 2020 taxes, given as an advance. So if you don’t get that advance, you’ll get the credit as extra money in your tax refund or taken off the taxes you owe. And no, the credit itself won’t ever be taxed.

Will everyone get a stimulus check?

At this point, no. People who make over the income threshold won’t get the check. People who don’t have a social security number, like some immigrant families, won’t get a check. And some dependents won’t get a check, either. That includes college students and kids over 16 years old who are claimed as dependents on their parent’s tax returns, older parents supported by their adult children, and people with disabilities who are supported by their parents.

Some lawmakers have proposed legislation that would give a $500 check for all dependents regardless of age, but so far that has not been passed.

I'm divorced with kids. Who gets the stimulus check for the kids?

The parent who claimed the children on their 2019 taxes will likely get credit for the kids.

How do I file for unemployment?

Do you need to file unemployment? You're joining millions of Americans who are doing the same thing. The CARES Act expanded who can get unemployment (sole proprietors, those in the gig economy), and how much people get – the stimulus bill added an extra $600 a week to unemployment benefits for up to four months.

While that all sounds good, filing is proving to be a little tricky. Online state unemployment systems are jammed with people filing at the same time, and it can be hard to get people on the phone. Both Washington and Idaho say they are working to fix website glitches and call wait times.

In addition, some state systems are not set up for the new folks who now qualify for unemployment, so the form questions may not fit.

The Washington site was updated on April 19, but is crashing a lot for people. The state says they're working on the kinks.

You can find the Washington and Idaho COVID-19 unemployment websites here: https://labor.idaho.gov/dnn/COVID-19

Payments are typically issued between a week to a few weeks after a state receives a claim. Experts say to just keep filing weekly claims during this period.

What should I do if I'm a sole proprietor or in the gig economy?

First, you can apply for unemployment through the state unemployment system now. Fill out the questions as best you can, and get yourself in the system. The CARES Act means that sole proprietors now qualify for unemployment, even if you didn't before.

Another option for sole proprietors are forgivable loans through the small business relief programs. One of those programs, the Payment Protection Program, opened to sole proprietors on Friday, April 10. This loan covers business expenses, including mortgage, rent and utilities. The PPP program ran out of its $350 billion in funds, but lawmakers are working to approve more money.

When those funds are available, you'll be able to apply for the PPP through banks, which are dispersing funds for the government. Check your bank website for a link to apply or contact your bank directly.

Can I file unemployment if I’m just furloughed (forced to take unpaid time off) or had my hours cut?

Usually yes. You can file for partial unemployment or unemployment for a brief period of time. There are some factors you need to meet to qualify. For example, in Washington, if you just have your hours cut by one day each week, you may not meet the income standards to qualify. To find out more about your specific situation, visit:

In Washington: https://esd.wa.gov/unemployment/temporary-layoffs

Can I get unemployment before my furlough starts?

If your company has planned a furlough in the future, you have to wait until the first day of your furlough to apply for unemployment. Then it depends on how quickly the state system is doling out cash as to when you’ll see a payment.

The good news is states say they are waiving waiting periods, and if you input your direct deposit information, you could see a payment within one to two weeks, but it may be a few weeks due to backlogs.

Payments are retroactive, though, so you should get paid for all of the weeks you qualified for unemployment.

I hear there's an extra $600 payment for unemployment claims, when will I get that money?

You will get the extra $600 at he same time as you receive your normal unemployment check. In Washington, those payments started in mid-April and will be retroactive to the start of the CARES Act. In Idaho, they're expected to start at the end of the month. There's nothing else you need to do after applying for unemployment to get the extra $600 a week.

What if I can't pay my mortgage or rent?

In Washington, Gov. Inslee has issued a moratorium on rental evictions, which means landlords can't currently evict tenants because they didn't pay rent this month. And in Spokane, Mayor Nadine Woodward banned residential and commercial evictions, as well as all fees related to late payments.

In Idaho, renters don't have as many protections and still need to pay rent on time to avoid penalties or evictions.

If you own your home, you can call your mortgage company for help. The federal government has advised lenders to provide some relief to homeowners, but it varies by lender and type of loan as to what kind of assistance you can receive. Some lenders are allowing you to pause payments and then just tack on those payments to the end of your loan, and others are requiring a big balloon payment at the end of the grace period. To find out what your lender offers, give them a call.

What about other bills like student loans, utilities and car payments?

The federal government has paused interest and required payments on student loans through Sept. 30. Many student loan companies have already paused any automatic payments you may have set up, but if you would like to stop paying your loans for a few months check with your servicer to make sure they know.

Likewise, your bank may offer relief from payments for property such as cars; allowing you to pause payments and then extend the life of your loan. Contact your lender to see if they will provide this kind of relief.

Utility companies are also granting grace periods for people in the Inland Northwest. Avista, Inland Power and Electric, and Kootenai Electric are some of the companies offering payment plans or extended due dates for your bills. But to get relief, like any other bill, you need to contact the company and set up that plan.

Note: Information related to financial assistance and coronavirus is changing quickly. This article will be updated but may not reflect all new policies.