SPOKANE, Wash. — Interest rates, home prices, and a lack of inventory are some of the reasons lenders said are why fewer people are applying for home loans in the last year. This means, for the median sale price in Spokane on a 30-year fixed-rate loan will cost buyers more than one million dollars.

A new snapshot report from the Spokane Association of Realtors shows inventory of homes on the market was up 2% in the month of September, despite the small increase, there is still not enough supply.

"There's not enough homes on the market right now, to be able to drive down the prices," said Troy Clute, Senior Vice President of Numerica's Home Loan Center.

Clute said climbing interest rates are causing a trickle down effect, potential sellers who don't want to let go of their low rates and buyers waiting for more options to open up.

"So a lot of people are on the sidelines, and they're just going to wait until rates start to come down before they put their house on the market. So that continues to keep inventory at a low," Clute said.

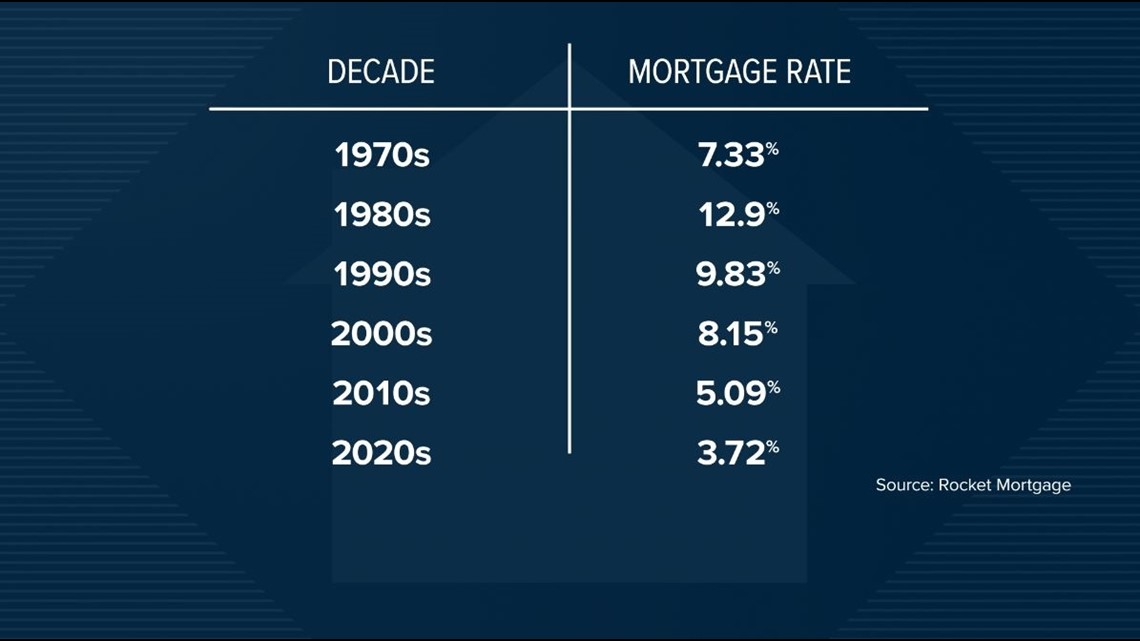

If interest rates are causing sellers and buyers to holdout, the question is, are rates today really out of the ordinary? Rocket Mortgage has tracked interest rates since the early 70's.

You may be surprised to learn rates in the past have been much higher.

In the early 80's interest rates nearly reached 13%, then through the early 2000's interest rates actually hovered between 8-9%.

It wasn't until the 2010's when interest rates drop to 5% and then to, as low as 3% in the early 2020's.

We have a whole generation now of people that that's all they know, because it's been a couple of decades. And these people entering the market right now are not conditioned to, to those types of rates. And neither is the market," said Jennifer Hentges, SNAP Housing Counseling Program Manager.

It's this shock, Hentges hears from people coming into SNAP for help buying a home.

"We have a lot of people coming in to the home buyer education courses, and they're all enthusiastic. And when they start learning what it's going to take, they get discouraged."

The U.S. Census Bureau reports the average household income in Spokane is about $64,000.

For those looking to buy a home with that income Hentges said people will not be approved for the median home price.

"That income will buy you probably somewhere between 250 and maybe not even $300,000 house," Hentges said.

This is the challenge for home buyers, the Spokane Association of Realtors report the median home price as of September was $409,000.

"The house payment for that amount at today's rates is about $3,335, which is a huge payment," Hentges said.

Hentges said this means a household needs to make about $115,000 to afford a home. However, it's not just the monthly payment, over the life of the loan people will pay a lot more in interest.

The median home price in Spokane in September of 2020 was $315,000. The interest rate then was 2.93% for a 30-year fixed-rate loan.

This means over the life of the loan someone would pay about $474,000 with a monthly payment of about $1,300.

Today the median home price in Spokane is about $410,000. The interest rate is about 8.6% for a 30-year fixed-rate loan. A large portion is interest and the monthly payment more than doubled from 3 years ago, now more than $3,000 per month.

This is the number that may surprise you, at today's interest rates you'll pay more than one million dollars over the life of the loan.

"That's not to say they can't refinance. But it does make a very big difference in what they can expect to pay over the life of the loan," Hentges said.

Lenders say you shouldn't bank on it, and expect to pay the rate you receive for a while. The good news, homes in this market continue to appreciate in value.

"So I think getting in right now and buying a home. Even with a higher interest rate, you have the option of refinancing later," Clute suggested.

SNAP offers home buyer education courses to help people navigate the process and connect them to down payment assistance programs.

"It's amazing to watch people get a home when they didn't think they were going to have a home, save their home from foreclosure when they thought there was no hope," Hentges said.

Lenders said the days of 3% interest are behind us, it could be a while before we see rates like that again, if ever.

Their best advice to home buyers, ask for help from a loan counselor and make the move when the numbers make sense for your budget.

Watch the full interview with Troy Clute, Senior VP of Numerica Home Loan Center