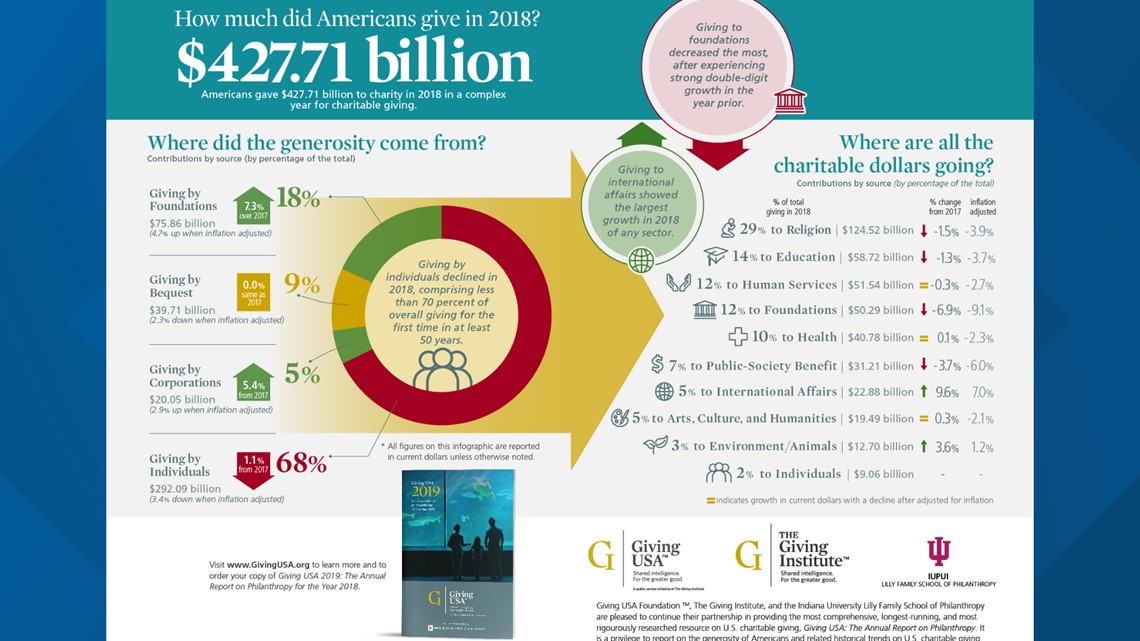

SPOKANE, Wash. — Charitable giving is down after years of growth, according to a new report by Giving USA.

The organization says changes to the tax law raised the standard deduction and may have taken away some incentive for people to give to charities.

The team at the Innovia Foundation works closely with more than 550 funds in Eastern Washington and Idaho. The team serves as a bridge to connect donors to non-profits and charitable organizations.

"Overall, adjusted for inflation charitable giving is down about 1.7 percent across the United States," said Aaron McMurray with the Innovia Foundation.

The 1.7 percent adds up to more than $727 million. That factors in giving from foundations, corporations and individual people.

But the drop wasn't from foundations and corporations, who actually gave more last year than 2017.

Last year, individuals donated $292.09 billion. That's a decrease of 3.4 percent, adjusted for inflation. The drop is potentially due to tax law changes that don't let individuals write off donations unless they can itemize more deductions than the standard.

Giving by foundations increased by an estimated 7.3 percent to $75.86 billion in 2018. That’s an increase of 4.7 percent, adjusted for inflation.

Giving by corporations increased by 5.4 percent in 2018, an increase of 2.9 percent adjusted for inflation. This totaled $20.05 billion.

Foundations like Innovia say smaller nonprofits will take the biggest hits because much of the decrease comes from individual and smaller donors. Since the report was released, they worked with organizations to make plans to offset the losses and encourage more donors.

"Maybe that might inspire additional generosity on their part if they begin to see that there is potentially a downward trend here in overall giving to non-profits," McMurray said.

Innovia is helping donors create donor advised funds. This allows people to give a lump sum in one year, claim it on the same year but divvy the funds over multiple years.

There are a lot of options and ways to support local charities, if you have questions about how the new tax laws impact your individual situation you should talk to an advisor or contact the Innovia Foundation.